Last Updated on: 22nd November 2023, 05:18 am

How to do your self employed tax return – lets go…

If you’re self-employed in the UK, filing a tax return is a crucial part of running your business. It’s important to keep accurate records of your income and expenses throughout the year, so that you can report your earnings to HM Revenue & Customs (HMRC) and pay the correct amount of tax.

Self-employed tax returns can be complex, but with the right guidance and preparation, you can ensure that you meet your obligations and avoid penalties. In this article, we’ll provide you with a step-by-step guide on how to do a self-employed tax return in the UK. We’ll cover everything from registering for Self Assessment to filling in your tax return and paying your tax bill.

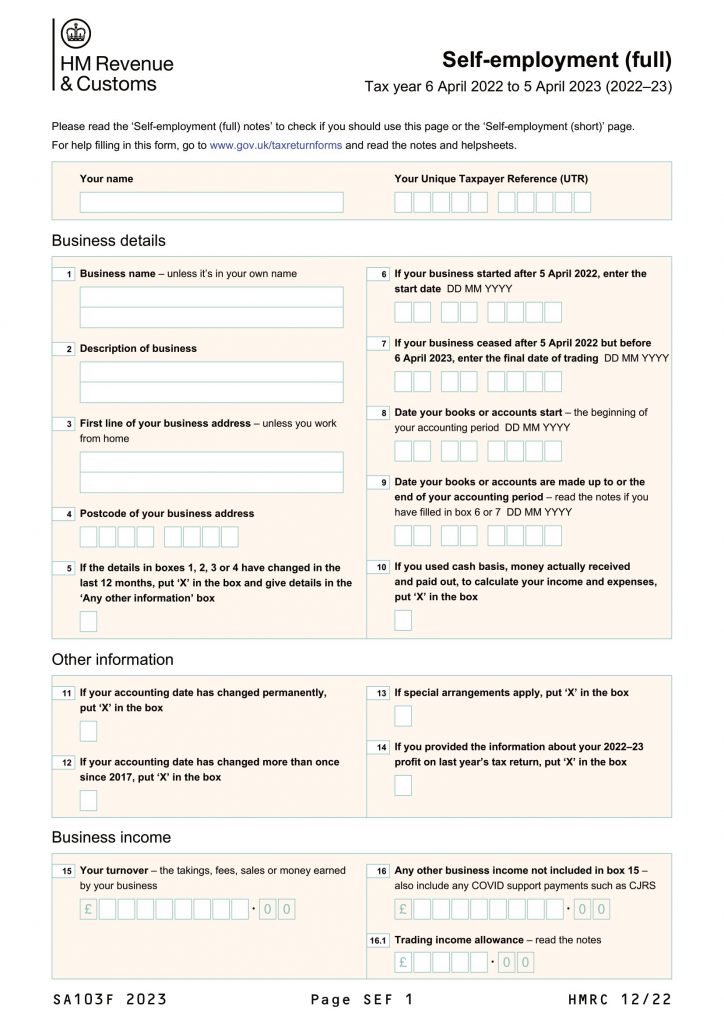

Download SA103F Form Below

Understanding Self-Employment Tax in the UK

If you are self-employed in the UK, you are responsible for paying your own taxes. This means that you will need to file a self-assessment tax return each year to declare your income and pay any taxes owed. The amount of tax you will need to pay depends on your profits and other factors such as your personal allowance, National Insurance contributions, and allowable expenses. When it comes to National Insurance contributions, self-employed individuals must pay both Class 2 and Class 4 contributions. The Class 2 contribution is a flat rate of £3.15 per week for the tax year 2022-23. Class 4 contributions are calculated as a percentage of your profits, with a rate of 9% on profits between £9,880 and £50,270, and 2% on profits above that amount. In terms of income tax, self-employed individuals are taxed on their profits, which is calculated by deducting allowable expenses from their income. For the tax year 2022-23, the basic rate of income tax is 20%, which applies to profits between £12,571 and £50,270. Any profits above this amount are subject to the higher rate of income tax, which is currently 40%. It is important to keep accurate records of your income and expenses throughout the year to ensure that you are able to complete your self-assessment tax return accurately and on time. You may also want to consider seeking the advice of a professional accountant or tax advisor to ensure that you are taking advantage of any available tax deductions and allowances. Overall, understanding self-employment tax in the UK can be complex, but with careful planning and preparation, you can ensure that you are meeting your tax obligations and avoiding any penalties or fines.

Registering for Self-Assessment

If you’re self-employed in the UK, you need to register for Self-Assessment with HM Revenue and Customs (HMRC). You must do this if you earned more than £1,000 before tax relief in the last tax year (6 April to 5 April). To register, you’ll need to provide some basic information about yourself and your business. This includes your name, address, National Insurance number, and details about your business, such as the date you started trading and your business type. You can register for Self-Assessment online through the HMRC website. Alternatively, you can register by post using form CWF1. Once you’ve registered, HMRC will send you a Unique Taxpayer Reference (UTR) and a Self-Assessment activation code. You’ll need these to file your tax returns and manage your tax affairs online. It’s important to register for Self-Assessment as soon as possible to avoid any penalties or fines. You must register by 5 October in your business’s second tax year. For example, if you started trading in June 2022, you must register by 5 October 2023. If you’re unsure about whether you need to register for Self-Assessment, you can use the HMRC’s online tool to check. This will help you determine whether you’re self-employed and need to register for tax. Overall, registering for Self-Assessment is a straightforward process that can be done online or by post. It’s important to register as soon as possible to avoid any penalties or fines. Once you’ve registered, you’ll be able to manage your tax affairs online and file your tax returns on time.

Gathering Records and Information

Before you begin to fill out your self-employed tax return, you need to gather all the necessary records and information. This includes:

- Records of all your sales and takings

- Receipts for all your business expenses

- Bank statements for all your business accounts

- Details of any other income you have received, such as rental income or interest on savings

- Information about any assets you have sold during the tax year

- Your National Insurance number

It’s important to keep accurate records throughout the year, so you don’t have to spend too much time gathering information when it comes to filling out your tax return. Keep all your receipts and invoices in one place and make sure you record all your income and expenses in a spreadsheet or accounting software.

If you’re unsure about which records you need to keep, or how to keep them, you can find guidance on the gov.uk website. This will help you understand what records you need to keep and for how long.

You may also need to provide additional information, such as details of any employees you have, or information about any company benefits you have received. Make sure you have all this information to hand before you start filling out your tax return.

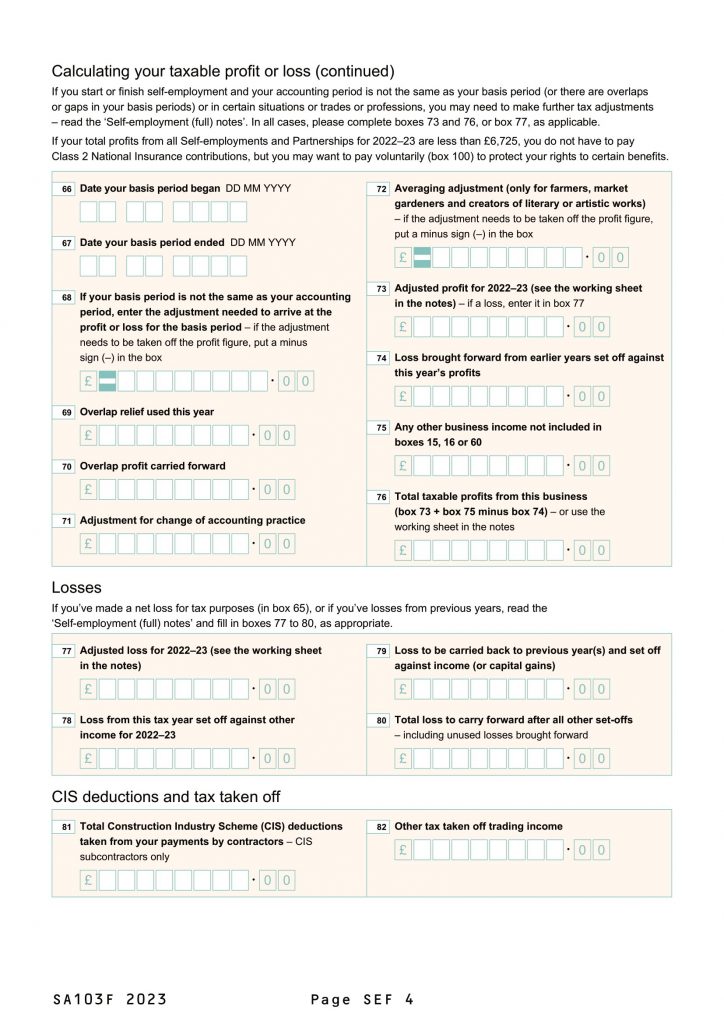

Calculating Your Taxable Profit

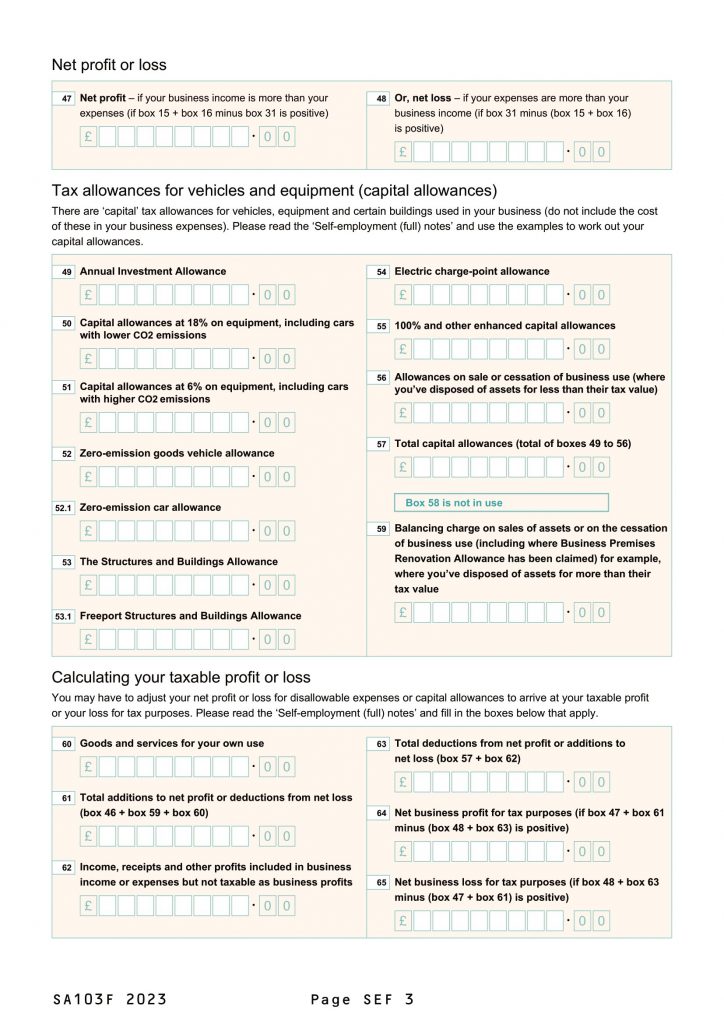

When it comes to self-employed tax returns in the UK, calculating your taxable profit is a crucial step. This is the amount of money you earned from your self-employment that is subject to income tax and National Insurance contributions.

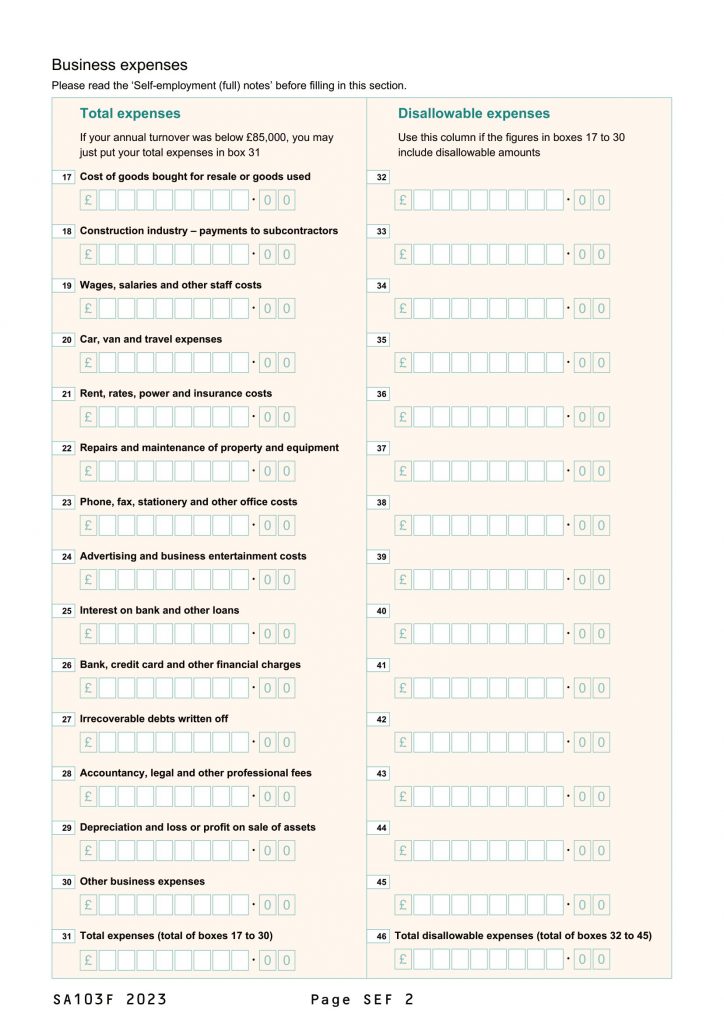

Expenses

To calculate your taxable profit, you first need to deduct any allowable expenses from your total income. Allowable expenses are costs that are necessary for running your business, such as office rent, equipment, and travel expenses. You can use the simplified expenses method to calculate some expenses if you work from home.

However, not all expenses are allowable. For example, you cannot claim expenses for personal items or expenses that are not related to your business. Make sure to keep accurate records of all expenses, including receipts and invoices.

Allowable Deductions

After deducting your allowable expenses from your total income, you can then apply any allowable deductions to arrive at your taxable profit. Allowable deductions include:

- Personal Allowance

- Capital Allowances

- Losses from Previous Years

Your Personal Allowance is the amount of income you can earn before you start paying income tax. Capital Allowances are deductions for the cost of buying and maintaining business assets, such as equipment and machinery. Losses from Previous Years can be carried forward and used to reduce your taxable profit in future years.

It’s important to note that some expenses and deductions have specific rules and limitations. For example, there are different rules for claiming Capital Allowances depending on the type of asset. Make sure to consult with a tax professional or use the resources available on the HM Revenue and Customs website to ensure you are claiming all allowable deductions correctly.

Filling Out the Self-Assessment Tax Return

As a self-employed individual in the UK, you are required to file a self-assessment tax return. This can seem daunting, but with the right guidance, it can be a straightforward process. In this section, we will guide you through the process of filling out the self-assessment tax return form.

Completing the Main Tax Return Form

The main tax return form is the SA100 form, which you can fill out online or on paper. The form requires you to provide information about your income, expenses, and tax liability for the tax year. Here are the steps to follow when filling out the main tax return form:

- Enter your personal details, such as your name, address, and Unique Taxpayer Reference (UTR) number.

- Declare your income from self-employment, employment, and any other sources.

- Declare your expenses related to self-employment, employment, and any other sources.

- Claim any tax reliefs or allowances that you are entitled to, such as the personal allowance or capital allowances.

- Calculate your tax liability for the tax year.

- Pay any tax due by the deadline.

Make sure to double-check all the information you provide and keep accurate records of your income and expenses.

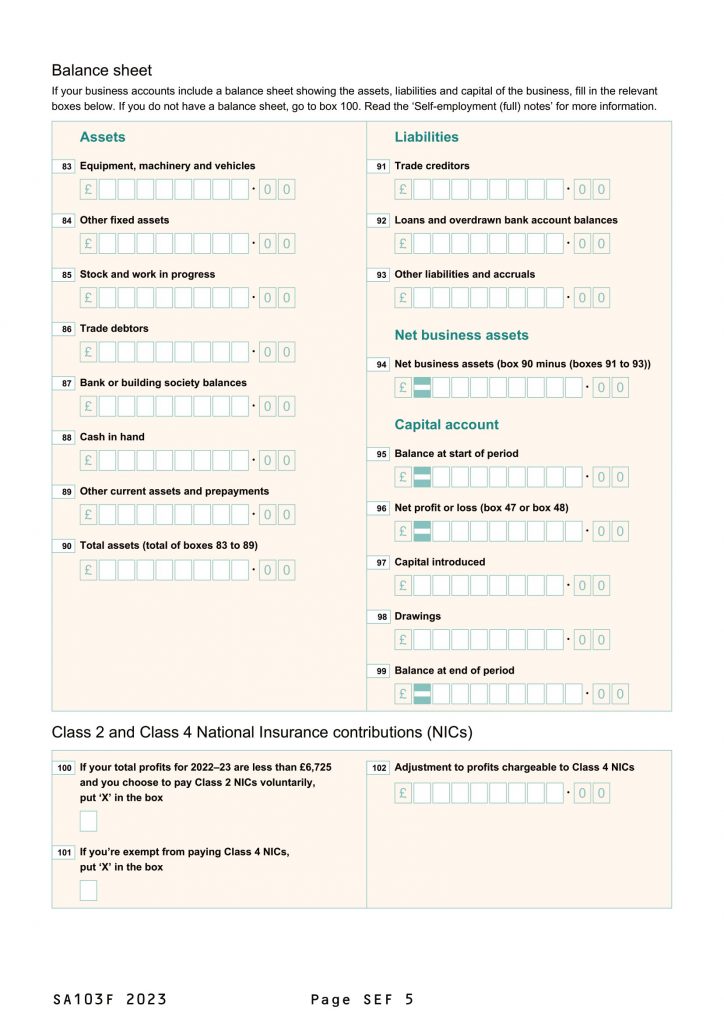

Additional Self-Employment Forms

In addition to the main tax return form, you may need to fill out additional forms depending on your circumstances. Here are some of the most common forms:

| Form | Purpose |

|---|---|

| SA103F | For self-employment income up to £85,000 |

| SA103S | For self-employment income over £85,000 |

| SA105 | For income from UK property |

| SA109 | For income from overseas |

Make sure to check which additional forms you need to fill out based on your income sources and consult the HMRC website or a tax professional if you are unsure.

Filling out the self-assessment tax return form can be a complex process, but by following these steps and seeking professional advice if needed, you can ensure that you are meeting your tax obligations as a self-employed individual in the UK.

Paying Your Tax Bill

If you are self-employed in the UK, you will need to pay your tax bill by the deadline to avoid being charged interest and penalties. Here are some ways to pay your tax bill:

- Pay online through your personal tax account or business tax account using HMRC online services.

- Pay through the official HMRC app.

- Pay by bank transfer.

- Pay by cheque through the post.

Make sure to check which payment methods are available to you, as some may not be available for certain types of taxes. It’s important to note that the deadline for paying your tax bill is usually the same as the deadline for submitting your tax return. For example, for the tax year 2022/2023, the deadline for submitting your tax return and paying your tax bill is midnight on January 31, 2024. If you are struggling to pay your tax bill, you may be able to set up a payment plan with HMRC. This will allow you to pay your bill in instalments over a period of time. However, you will still need to pay interest on the amount you owe. Remember, it’s your responsibility to make sure you pay your tax bill on time. Failure to do so can result in penalties and legal action. If you’re unsure about how much you owe or when your payment is due, you can check your personal tax account or contact HMRC for assistance.

Important Deadlines and Penalties

As a self-employed individual in the UK, it is essential to keep track of important tax deadlines to avoid penalties and interest charges. Here are some of the critical deadlines you need to know:

- 31st January – This is the deadline for filing your self-assessment tax return online and paying any tax due for the previous tax year.

- 31st July – If you make payments on account, this is the deadline for making your second payment for the current tax year.

- 5th October – If you are a new self-employed individual, this is the deadline for registering with HM Revenue and Customs (HMRC).

- 31st October – If you submit your tax return on paper, this is the deadline for filing your self-assessment tax return and paying any tax due for the previous tax year.

It is important to note that missing these deadlines can result in penalties and interest charges. For example, if you miss the 31st January deadline for filing your tax return, you will be charged an initial penalty of £100. If you still haven’t filed your tax return after three months, you will be charged an additional penalty of £10 per day for up to 90 days. If you miss the deadline for paying your tax bill, you will be charged interest on the amount owed. The interest rate is currently 2.6%, and it is charged from the date the payment is due until the date it is paid in full. To avoid penalties and interest charges, it is crucial to keep track of these deadlines and ensure that you file your tax returns and pay any tax due on time. If you are struggling to meet these deadlines or need help with your tax return, consider seeking professional advice from a qualified accountant or tax advisor.

SA103F Form