Last Updated on: 13th May 2024, 06:10 pm

Study Forecasts Dramatic Rise in Patient Numbers and Market Growth

A surge in medical cannabis consumption is propelling the UK to the forefront of Europe’s emerging market, new projections suggest. By 2028, the number of medical cannabis patients in the UK is anticipated to skyrocket by 124%, reaching around 141,000 individuals, according to data from a report released today by Prohibition Partners, a UK-based cannabis data and intelligence company.

The report highlights that the UK, spearheaded by a surge in sales and demand, is driving fresh momentum in Europe’s medical cannabis sector. It indicates that consumption volumes per patient in the UK are notably higher than previously anticipated, setting the nation apart as a significant player in the burgeoning industry.

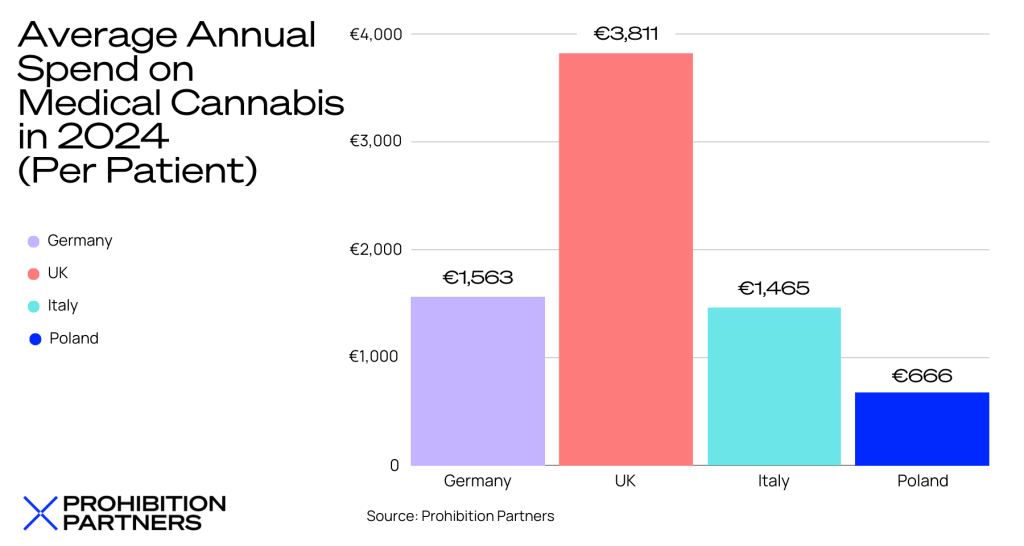

For instance, by the close of 2024, an estimated 62,960 patients are projected to be utilizing medical cannabis in the UK, generating €240 million (£205 million) in sales. This translates to an average annual consumption of €3,811 (£3,261) per patient, or €318 (£272) per month. In stark contrast, Germany, boasting Europe’s largest medical cannabis market, sees its patients consuming €1,563 (£1,342) worth of medical cannabis annually, or €130 (£112) per month.

The disparity in spending, the report suggests, is primarily fueled by markedly higher consumption volumes rather than price differentials. Notably, average prices per gram of dried medical cannabis flower or milliliter of oil are lower in the UK compared to Germany.

The report’s findings shed light on the driving forces behind the UK’s elevated consumption rates. Lawrence Purkiss, Senior Analyst at Prohibition Partners, attributes the phenomenon, in part, to the UK’s entirely private and self-paid market structure, which incentivizes high prescription volumes.

Stephen Murphy, co-founder and CEO of Prohibition Partners, underscores the significance of the findings, noting that since the legalization of medical cannabis in 2018, private companies have sought to expand options and accessibility for patients. However, supply chain constraints and costs often prompt patients to prioritize volume over frequency, underscoring the need for regulatory streamlining and improved affordability.

Looking ahead, the report forecasts a staggering growth trajectory for the UK’s medical cannabis market. By 2028, the country is expected to host approximately 141,000 medical cannabis patients, marking a 124% increase from the end of 2024. In comparison, Germany anticipates a growth rate of just 24%, with around 346,000 medical cannabis patients projected by 2028.

Crucially, private clinics, rather than the National Health Service (NHS), largely facilitate patient access to medical cannabis in the UK. These clinics, supplied by major distributors like Curaleaf Laboratories, have witnessed a surge in demand. Jonathan Hodgson, CEO of Curaleaf Laboratories, notes that 2024 has seen remarkable growth, with a record number of UK private clinics now offering medical cannabis treatment at reduced appointment costs.

The findings from the report, titled “The European Cannabis Report: 9th Edition,” underscore the dynamic landscape of the medical cannabis industry in the UK and Europe. Interested parties can access a free version of the report via the Prohibition Partners website.