Last Updated on: 22nd November 2023, 04:18 pm

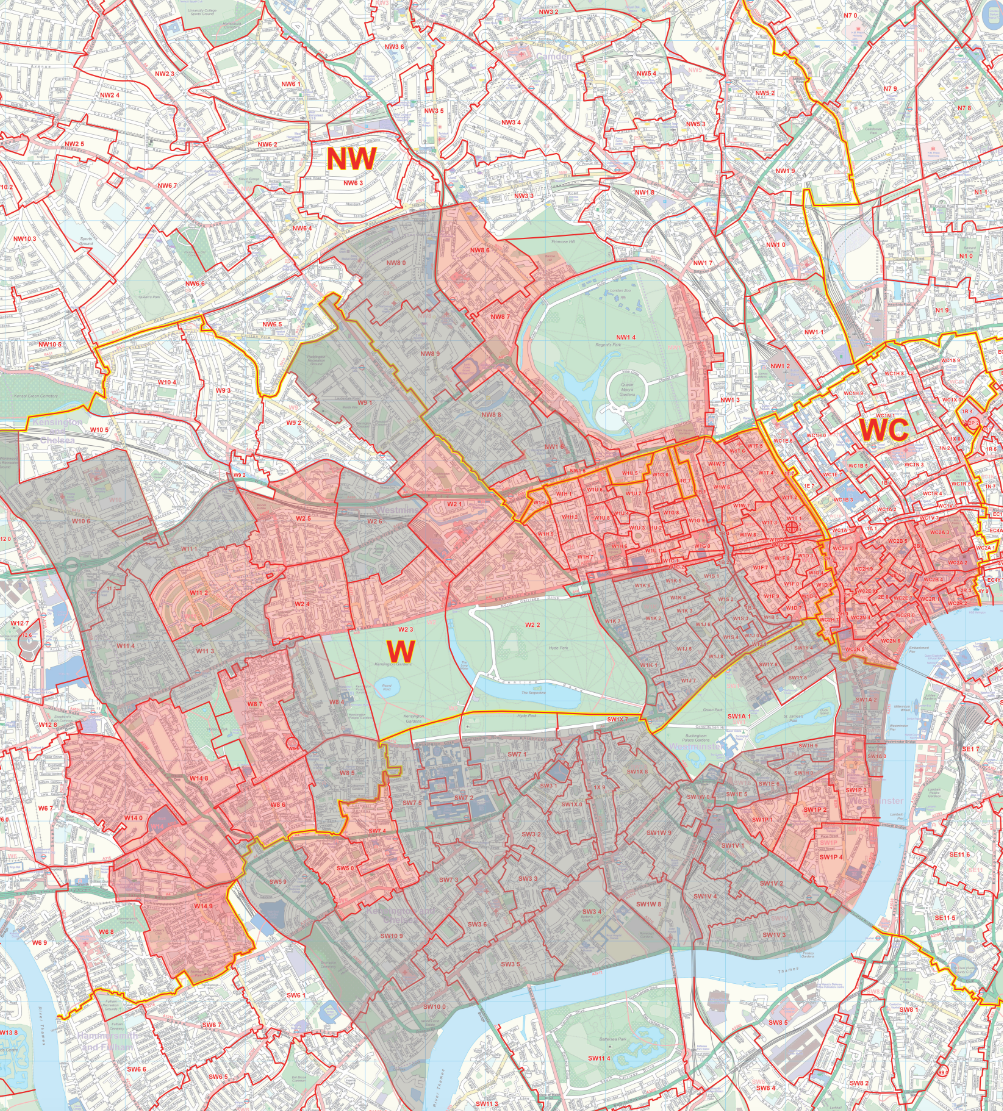

- Paddington and Bayswater [ W2 (1,2,3,4,5) & W11 2 ]

- Marylebone and Fitzrovia [ W1 (H, T,W,C, G, U) ]

- Soho and Covent Garden [ W1 (D,F) & WC2 ]

- Regents Park and St John’s Wood [ NW1 (4,5) & NW8 (6,7) ]

- Pimlico and Victoria [ SW1P (1,2,3,4) ]

- Earl’s Court and West Kensington [ SW5 0 & SW7 4 & W14 (0, 8, 9) ]

- Kensington High Street [ W8 (6,7) ]

A snapshot of the Prime Central London (PCL) residential property market made up of London’s two most exclusive boroughs, the Royal Borough of Kensington and Chelsea and the City of Westminster, reveals that average prices are now at £1.6m, with average rolling price growth of 5% over the last 12 months. Since records were first published in 1996, growth has averaged 9% per annum.

Within this tiny area, however, of just six square miles and fewer than 200,000 households, prices and long-term growth vary considerably. Pockets of non-prime properties are located next to traditionally affluent areas and social housing run side by side with landed estates. With current uncertainty surrounding Brexit and a series new taxes impacting the market, knowing where to invest becomes more important than ever.

In the more traditional area south of Hyde Park such as Knightsbridge and Belgravia, average prices have hit highs of £4.7m. With growth over 13% per annum, Residential Experts London Central Portfolio (LCP) predict that this is likely to taper off with other up-and-coming areas taking the slack.

“Understanding the nuances of London’s diverse boroughs can make or break an investment. Iconic architecture and key transport links to London’s financial districts and international airports has seen London’s centre of gravity shift from the Kensington and Chelsea’s traditional enclaves to neighbouring City of Westminster. Home to the likes of Buckingham Palace, the Houses or Parliament and some of the world’s top universities, this area benefits from future growth and gentrification potential. There is plenty of opportunity for those who know where the opportunities are,” comments Naomi Heaton, CEO of London Central Portfolio, “particularly in a market, subdued by the uncertainty of Brexit and the current tax headwinds”.

LCP have subdivided PCL into 52 postcode sectors to pinpoint the coming hot-spots, taking into account their current average prices and price growth over the last 20 years, on the basis that “lower is better” as there is more potential for growth.

According to the research, the area north of Hyde Park, in the stretch from Bayswater to Fitzrovia and up to Regents Park and Maida Vale is stealing the march. For those on the hunt for the best deals, average prices here can stand 20% lower than the PCL average.

“With Paddington and Kings Cross Station within their vicinity and an array of rundown commuter hotels and offices transforming into ‘des-res’, these postcodes hold a winning hand in terms of investment potential. Add Crossrail coming in through Paddington and Tottenham Court Road and the virtues of real estate here are clear to see” adds Heaton.

The company also moot the more peripheral areas around Victoria and Earl’s Court Exhibition Centre as hot investment areas. Like the areas north of Hyde Park, until recently, these zones have been held back by urban degradation around Victoria Station and the Cromwell Road, linking to the M4. The flip-side, however, is that pockets of attractive and innovative architecture, coupled with all important transport links and infrastructure means they are beginning to catch-up.

Less anticipated due to its higher price tag, LCP have also identified a growth zone in Kensington’s picturesque Stratford Village (W8 6), abutting Holland Park, and north of Kensington High Street where older but well-run Mansion Blocks hit the rental market sweet spot.

“Isolated pockets such as this underpin why drilling down to PCL’s micro-markets is so important. Whilst, as a whole, the area around Kensington’s main hub is often seen as overpriced, some of the real estate here actually presents an exciting investment opportunity. Unlike the large, trophy properties close by, property here tends to be subdivided into much smaller units. These are perfect for the rental market where one and two bedroomed flats, commanding rents of less than £1,000 per week, are the most profitable with the lowest void periods and considerably higher yields.”