Every second counts and every transaction carries weight in the world of institutional finance. People are all too familiar with the challenges of processing large-scale payments, be it delays in settlement, opaque transfer pathways, or the limited programmability of legacy systems. But as digital transformation continues to evolve financial infrastructure, one innovation is emerging as a game-changer: digital token-based electronic payment systems.

This blog explores how digital tokens, tokenized representations of value, are reshaping B2B payment flows at the institutional level. We’ll discuss what makes this approach so revolutionary and how it compares with traditional systems. The blog will also cover why financial institutions should begin preparing for a future that’s built on programmable money and faster settlements.

Understanding Traditional Payment Infrastructure

To appreciate what’s changing, we need to understand the status quo. Traditional institutional payments rely on centralized intermediaries, banks, clearinghouses, and custodians, each playing a role in the settlement and reconciliation process. This web of intermediaries leads to fragmented systems, redundant processes, and delayed settlements. For large-scale business transactions, these inefficiencies result in added costs, trapped liquidity, and operational risks.

Settlement of cross-border transactions, for example, often takes days, with each intermediary introducing a layer of complexity. The lack of real-time visibility can create audit challenges and compliance headaches. In such systems, money moves slowly, with limited flexibility or automation. It is in this setting that digital token-based electronic payment emerges as a revolutionary solution.

The Rise of Tokenization in Payments

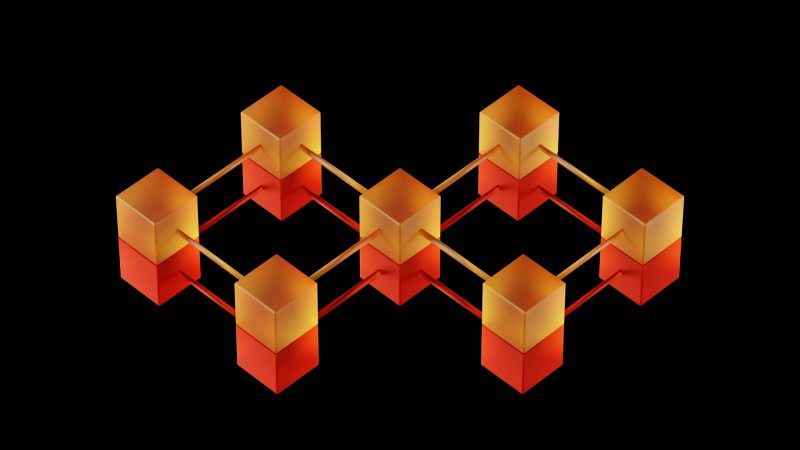

Tokenization refers to the process of converting real-world assets or fiat money into digital tokens that can be securely transferred across blockchain or distributed ledger platforms. In the case of digital token-based electronic payment, these tokens act as a unit of value, representing fiat currencies but with the added capabilities of programmability and real-time movement.

Unlike traditional systems that rely on batch processing and end-of-day reconciliation, tokenized payments can be settled instantly. The token, embedded with metadata, can carry transactional instructions, audit trails, and compliance parameters, reducing the need for manual oversight.

Key Advantages of Digital Token-based Electronic Payment Systems

Let’s examine the key benefits that make this infrastructure so compelling for institutional users:

- Improved Settlement Times

Traditional payments often take T+1 or T+2 days to settle, especially in institutional contexts. With digital token-based electronic payment, settlement can happen in near real-time. Once a token is transferred and validated on the network, the transaction is complete, no more waiting for middlemen to process the transfer.

This speed reduces counterparty risk and frees up capital that would otherwise be stuck in limbo. Institutions can deploy their funds more strategically, optimize liquidity, and increase operational efficiency.

- Programmable Transfers

One of the excellent features of digital token-based electronic payment systems is programmability. Unlike static money transfers, digital tokens can be coded to perform certain actions, like releasing payment upon fulfillment of conditions, enforcing regulatory rules, or automating recurring payments.

This unlocks new levels of flexibility in complex transaction scenarios. Escrow, compliance checks, and conditional settlements can all be integrated into a single token transaction, reducing administrative overhead and manual errors.

- Enhanced Auditability

Tokenized payments are built on distributed ledgers or blockchains, which means every transaction is traceable and tamper-proof. Each digital token-based electronic payment includes a complete, immutable history of the transfer, making audits more straightforward and compliance easier.

Financial institutions can use this to strengthen internal controls, reduce fraud, and enhance their reporting systems. For regulators, this means faster access to trusted data without relying on outdated reporting mechanisms.

Metadata: The Silent Enabler of Secure Transactions

Beyond the token itself, one of the most powerful aspects of a digital token-based electronic payment is the metadata it can carry. Metadata refers to information about the transaction, such as who initiated it, for what purpose, and under what conditions it should be executed.

By embedding this data directly into the token, payment systems gain a new layer of security and customization. Institutions can tag payments with identifiers, trace payments back to source funds, and enforce smart contract conditions that prevent misuse or misrouting.

This level of granularity allows for more secure, compliant, and purpose-specific payments, making digital token-based electronic payment solutions ideal for high-value or sensitive transactions.

Comparing Traditional and Tokenized Payment Models

Let’s break down the differences between traditional and tokenized systems more clearly:

| Feature | Traditional Payments | Digital Token-based Electronic Payment |

| Settlement Speed | T+1 or more | Instant/real-time |

| Intermediaries | Multiple | Minimal / Peer-to-peer |

| Programmability | None | Fully programmable |

| Reconciliation | Manual | Automated |

| Audit Trail | Fragmented | End-to-end visibility |

The contrast highlights why institutions are increasingly exploring digital token-based electronic payment frameworks to modernize their backend systems and reduce friction in their financial operations.

A Conceptual Shift in Institutional Payments

The transformation underway is not just technical; it’s conceptual. Payments are evolving from simple instructions to dynamic, intelligent, and secure forms of value transfer. The move toward digital token-based electronic payment marks a turning point for how institutions interact with capital, customers, and partners.

It’s not about chasing trends; it’s about building future-ready infrastructure that aligns with the demands of a digital economy. As adoption grows and standards solidify, these systems will likely become the new normal in enterprise-level financial operations.

In the years ahead, expect digital token-based electronic payment systems to power not just faster transactions but smarter, safer, and more adaptable financial ecosystems. Those looking to stay ahead of the curve are already exploring platforms such as rootVX, built with this mindset, where innovation meets institutional scale and long-term reliability.