Last Updated on: 22nd November 2023, 11:42 am

If you’re planning to trade with countries outside the UK, you may have heard of an EORI number. EORI stands for Economic Operators Registration and Identification number. It’s a unique identification code that businesses and individuals use in all customs procedures when exchanging information with Customs administrations.

If you’re based in the UK, you’ll need an EORI number that starts with GB to import and export goods to the EU. You’ll also need one if you’re based in Northern Ireland and move goods between Northern Ireland and non-EU countries.

Getting an EORI number is a straightforward process, but it’s essential to have one if you want to trade internationally. This article will explain what an EORI number is, who needs one, and how to get or check one.

What is an EORI Number?

- If you’re involved in international trade, you may have heard of an EORI number. This stands for “Economic Operators Registration and Identification” number, and it is a unique ID code used to track and register customs information in the European Union (EU).

Essentially, an EORI number is a way for customs and other authorities to monitor and track shipments coming into and out of the EU. It is used as an identification number in all customs procedures when exchanging information with Customs administrations.

It is important to note that an EORI number is not just for businesses. Individuals who are involved in international trade, such as importing or exporting goods, also need an EORI number.

So, how do you get an EORI number? The process varies depending on where you are located and whether you are an individual or a business.

If you are a business based in the UK, you can apply for an EORI number through the UK government website. If you are an individual based in the UK, you can apply for an EORI number through the same website, but you will need to provide additional documentation to prove your identity.

If you are based in another EU country, you will need to apply for an EORI number through your country’s customs authority.

Who Needs an EORI Number?

If you are an individual or a business entity that is registered in the European Union and involved in international trade, you need an EORI number. The number is used in all customs procedures performed by economic operators, which includes import and export of goods.

It is important to note that economic operators not established in the customs territory of the Union also need an EORI for a number of different situations. For example, if you are a non-EU company that is selling goods to customers in the EU, you will need an EORI number to clear customs. Similarly, if you are a UK company that is exporting goods to a non-EU country, you will need an EORI number to clear customs in the destination country.

If you are importing or exporting goods, you will need to provide your EORI number to customs authorities. Failure to provide your EORI number can result in delays and additional costs, as customs authorities will need to manually process your shipment.

It is also important to note that if you appoint someone to deal with customs for you, you will need to provide them with your EORI number. This can include freight forwarders, customs brokers, or other third-party service providers.

How to Get an EORI Number

UK Businesses

If you are a UK business that imports or exports goods with countries outside of the European Union (EU), you will need to have an Economic Operator Registration and Identification (EORI) number. To get an EORI number, you can apply online through the UK Government website. You will need to provide your business’s Unique Taxpayer Reference (UTR), which you can find on your tax return or other documents from HM Revenue and Customs. You will also need to provide your business start date and Standard Industrial Classification (SIC) code, which can be found in the Companies House register.

When you apply for an EORI number, you will need to have a Government Gateway user ID and password. If you don’t already have one, you can create one during the application process. Once you have submitted your application, you should receive your EORI number within three working days.

Non-UK Businesses

If you are a business based outside of the UK that imports or exports goods with countries outside of the EU, you will also need to have an EORI number. The process for getting an EORI number will depend on the country where your business is based.

If your business is based in an EU country, you can apply for an EORI number through your country’s customs authority. You can find a list of EU customs authorities and their contact details on the European Commission website.

If your business is based outside of the EU, you can apply for an EORI number through the customs authority of the first EU country where you will be importing or exporting goods. You will need to provide your business’s registration documents and other relevant information.

Sole Traders

If you are a sole trader who imports or exports goods with countries outside of the EU, you will also need to have an EORI number. The process for getting an EORI number is the same as for UK businesses. You can apply online through the UK Government website and provide your Unique Taxpayer Reference (UTR), business start date and Standard Industrial Classification (SIC) code. You will also need to have a Government Gateway user ID and password.

How to Check an EORI Number

UK EORI Number Check

If you are based in the UK and have an EORI number, you can check its validity by visiting the UK government website. Simply enter your EORI number and click on the “Check” button. If your EORI number is valid, you will receive a confirmation message. If your EORI number is not valid, you will need to apply for a new one.

Non-UK EORI Number Check

If you are based outside of the UK and have an EORI number, you can check its validity by visiting the European Union’s EORI validation website. Select the country where your EORI number was issued from the drop-down menu, enter your EORI number, and click on the “Validate” button. If your EORI number is valid, you will receive a confirmation message. If your EORI number is not valid, you will need to contact the relevant authorities in your country to apply for a new one.

It is important to check the validity of your EORI number before using it for customs purposes. If your EORI number is not valid, your shipments may be delayed or even refused entry into the customs territory of the European Union.

Conclusion

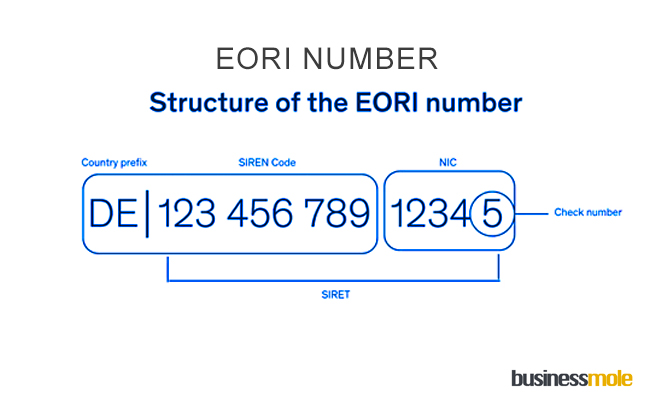

Obtaining an EORI number is a necessary step for businesses and individuals wishing to trade within the European Union. It is a unique identification number that is used in all customs procedures when exchanging information with Customs administrations. The EORI number is created using the intra-community VAT identifier format, but adding the country prefix. Thus, if your VAT number is B 87654321, your EORI number will be FRB 87654321.

It is important to note that EORI numbers are not transferable between individuals or companies, and they must be obtained in each country where the individual or company wishes to trade. Additionally, EORI numbers must be renewed if there are any changes to the information provided during the initial registration process.

Fortunately, obtaining an EORI number is a relatively simple process that can be completed online. The specific process may vary slightly depending on the country of registration, but the basic steps involve filling out an application form and providing the necessary documentation to prove your identity and business registration status. Once your application is approved, you will receive your EORI number and can begin trading within the European Union.

Remember, having an EORI number is essential for businesses and individuals who wish to trade within the European Union. By following the steps outlined in this article, you can obtain your EORI number and ensure that your trading activities are compliant with EU customs regulations.