Last Updated on: 22nd November 2023, 08:57 am

Sharpe Capital, a tech-driven investment fund specializing in global financial markets announces an advisory partnership agreement with Token-as-a-Service (TaaS), the first-ever tokenized closed-end fund dedicated to blockchain assets, before their token issuance in November.

TaaS and Sharpe Capital are delighted to announce their exciting new partnership. The TaaS – Sharpe cooperation agreement was finalized following a meeting at the recent d10e Blockchain Conference in Kyiv, Ukraine, which was co-hosted by TaaS and attended by Sharpe’s co-founders Lewis Barber and Dr. James Andrew Butler.

Sharpe Capital is a FinTech organization developing a platform to crowd-source market sentiment on global equities and blockchain assets, paying service fees in Ether to users in return for their insight. Supplemented with cutting edge, machine learning-driven linguistic analysis and quantitative trading strategies developed in collaboration with leading academic partners, Sharpe Capital aims to deliver best-in-class data-feeds for use by investors.

Sharpe Capital will issue a SHP tokens via the Ethereum blockchain during a 7 day discounted pre-sale beginning 6th November, with $1.4MM whitelist registration places remaining. This will be followed by a 28 day crowd sale, with a total cap of $20MM. SHP permits participants to provide sentiment, and institutional investors to access their cloud-based quantitative trading model tools. Sharpe Capital will also operate a proprietary investment fund, both in global equities and blockchain assets, with plans to issue a derivative token instrument tied to its performance in Q1 2019. Sharpe Capital is seeking to raise $20 Million through SHP issuance in November.

Chief Investment Officer of Sharpe Capital, Dr. Butler, described the newly announced advisory partnership: “It is a fantastic opportunity for synergy between the leading blockchain fund TaaS and the Sharpe Platform suite of products, including our market sentiment crowd-sourcing application and machine learning-driven investment funds. TaaS Fund’s advice has already proven invaluable and I’m really looking forward to what will no doubt be a prosperous relationship for both parties.”

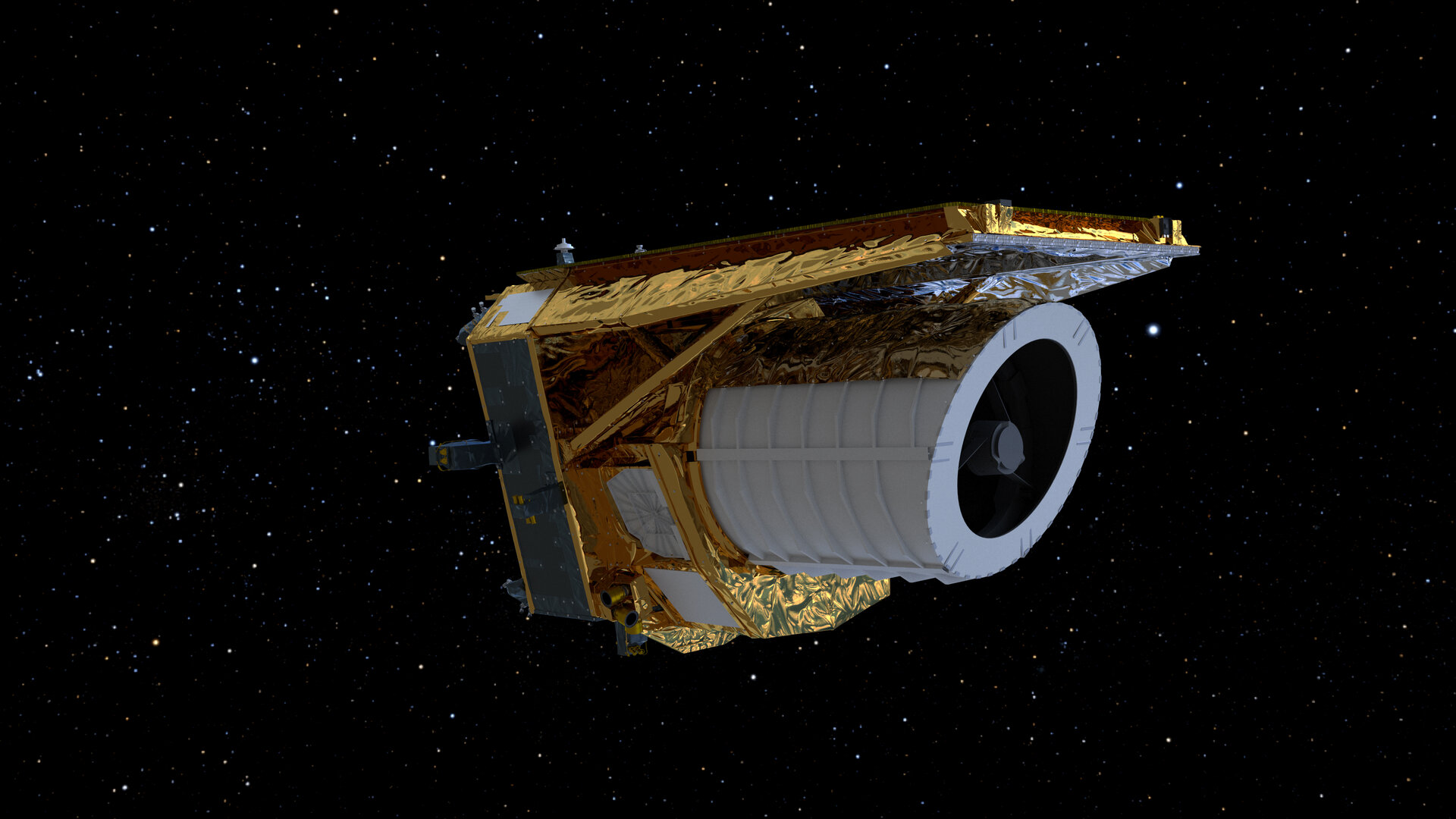

TaaS launched the first-ever tokenized closed-end fund dedicated to blockchain assets in May 2017 right after its Token Sale concluded, with $7.6 million USD(T) raised. During its first fully-operational quarter TaaS participated in eleven token generation events with the total amount contributed equivalent to 3 million USD(T). This delivered an unprecedented 61% ROI and over 300% growth in market cap. Since then, TaaS is actively continuing contribution and trading performance accelerating integration and linkages within the cryptoworld.